A lot of responsibility comes with running any American business nowadays, and people expect you to be able to protect their information at all times.

This is one of the reasons why American businesses, the length and breadth of the country, invest not only time but an incredible amount of money, making sure that data integrity is protected, that security is provided, and that transparency is there for all to see.

It used to be the case that we would use humans to provide audits, but everything has changed, and we can now use blockchain technology for such things.

If you are unfamiliar with the blockchain audit, the easiest way to describe the whole thing is that at the very centre of everything, every transaction or block, is always linked to the previous transaction in some way.

Due to its transparent nature, once something is recorded, it cannot be changed later, which not only provides you with a system with better integrity, but one with more auditability as well. This way of doing things has changed how real auditors work, and it’s for the better.

The following are some of the ways that it’s transforming not only auditing, but also other information systems, here in America.

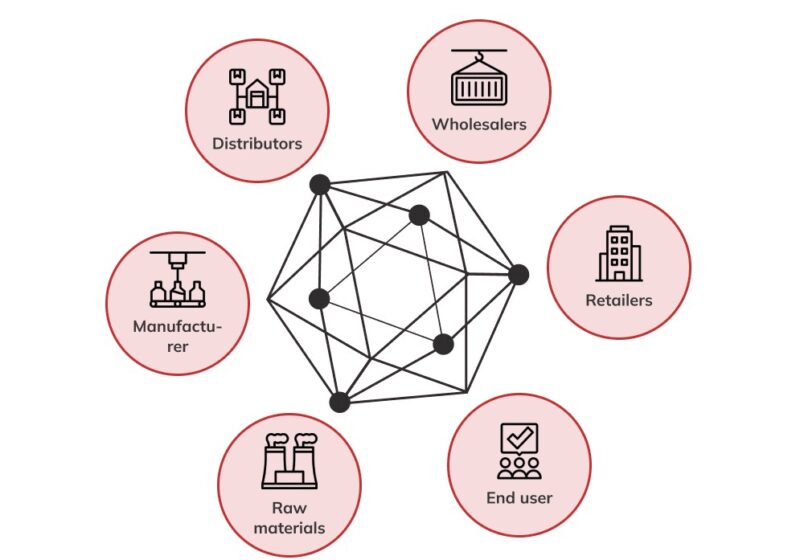

For Supply Chain Management

Every business needs to know where its goods are at any particular time, and this is when blockchain becomes incredibly useful. Every transaction or transfer is recorded, which helps to make everything more transparent and allows better verification as well.

This cuts down on the amount of fraud that happens in the supply chain, as well as reducing the chances of counterfeit goods.

For Smart Contracts

When it comes to agreements nowadays, everything is carried out digitally, and then it’s stored on a network. Once blockchain is put into place, if the terms and conditions of the contract are carried out to the letter, the digital agreement is executed automatically.

This all helps improve overall efficiency and accuracy. The whole process is auditable, helps to reduce costs, and definitely increases trust among the different parties.

For Financial Auditing

Anyone who has worked in the financial sector before as an auditor will tell you that doing so requires an incredible amount of work and time. Human error always creeps into the equation, and this is when blockchain technology helps to change everything, for the better.

Transactions can be tracked in real time, financial reports can be checked as to their accuracy, and mistakes and other discrepancies can be managed more efficiently. This all helps to reduce the amount of time and money spent when it comes to financial auditing and reporting.

Expanding the Role of Blockchain Audits

Beyond these sectors, blockchain audits are becoming a foundation for other industries that rely heavily on trust and traceability. In the healthcare sector, for instance, blockchain ensures that patient records are encrypted, securely stored, and only accessible to authorized parties.

A blockchain audit in this environment allows healthcare providers to demonstrate compliance with HIPAA regulations while offering full transparency about data access.

In the real estate industry, smart contracts and blockchain-based record systems are transforming how ownership and title transfers are recorded. Previously, property transfers required multiple intermediaries and manual verification steps. Now, with blockchain audit trails, these transactions can be verified instantly, making property sales faster, cheaper, and more secure.

Government agencies across the United States are also experimenting with blockchain audits to increase accountability. Public procurement, tax collection, and even election data can be recorded on decentralized ledgers to ensure that every modification is traceable. Such transparency could redefine public trust in institutions by providing immutable audit trails for critical civic processes.

Benefits for Compliance and Risk Management

American businesses face ever-tightening regulatory requirements. Blockchain audits reduce compliance risks by creating a single, verifiable source of truth. Whether it’s for Sarbanes-Oxley, GDPR, or financial disclosure requirements, auditors can rely on blockchain data as tamper-proof evidence.

Moreover, continuous auditing becomes possible, instead of yearly manual reviews, blockchain systems enable ongoing, real-time verification.

Another key advantage lies in cybersecurity. Traditional auditing systems are vulnerable to manipulation or unauthorized access, but blockchain’s distributed nature minimizes single points of failure. Even if one node is compromised, the rest of the network maintains data integrity.

For U.S. corporations under pressure to protect consumer information, blockchain audit systems serve as a technological safety net that goes far beyond what human oversight alone can offer.

Challenges and the Road Ahead

Despite its advantages, adopting blockchain audit systems isn’t without challenges. Integration with existing legacy systems can be complex and costly. Additionally, many auditors must acquire new technical skills to interpret blockchain-based records accurately.

However, companies that invest early in blockchain literacy will gain a major strategic edge, as demand for professionals who understand decentralized auditing continues to grow.

In the coming years, blockchain audit services like those provided by Hashlock will likely play an even greater role in American business ecosystems. As industries continue to digitize, the ability to produce verifiable, real-time audit trails will become not just a competitive advantage but a legal necessity.

Looking Toward a Transparent Future

Blockchain technology is here to stay, and especially within the audit industry. It provides businesses with a more transparent way to do things, and everything is recorded in the correct manner. It is used within the supply chain management field, within financial auditing, and even in the healthcare industry. It provides a better and trustworthy way to manage information.

As more American companies adopt blockchain audit solutions, auditing will move from being a backward-looking process to a dynamic, continuous one, ensuring integrity, transparency, and trust in every transaction.